**Updated November 2, 2022**

Which retirement account is best?

Many of you have heard us say before that the single best tax deduction is contributing to a retirement account. It is a 100% deductible expense and is tax deferred while the asset grows to your full retirement age. There is nothing else out there that you can “pay yourself” and get a full deduction for putting money in your own pocket.

A retirement plan is a great tool for shop owners to use to lower taxable income, increase retirement savings, and even manage the future of their business. It is a tool no shop owner can afford to ignore. It can also give you the upper hand for hiring. We all know it is tough to find good techs right now. Offering a retirement plan (and other fringe benefits) can make a huge difference when a tech is choosing where to work.

But how do you know which retirement account is best for you and your shop? Below, we go through some of the common types of retirement accounts and which one is best for who.

Business-Sponsored Plans –

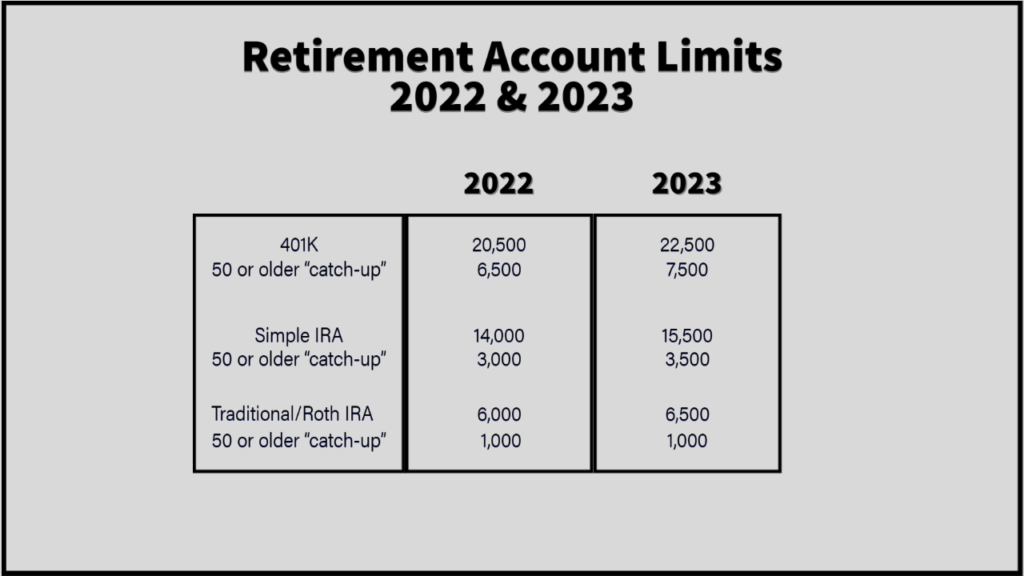

- SIMPLE IRA – This plan is a great place to start. This is an employer-sponsored plan, meaning owners are eligible but they also have to offer it to all employees with a match. The 2023 contribution limit is $15,500 ($19,000 age 50 and older). Employers usually match about 3% of employees’ salary. If your employees do not choose to contribute, you can also offer a “safe harbor” match where you still put in a certain % for all employees. These contributions are run through payroll as a payroll tax deduction. For owners, if your spouse is not on payroll, get them on there so they can also contribute up to $15,500 for a total of $31,000 between the two of you. These contributions must be made by the end of the year, so tax planning with this retirement plan is crucial for tax savings. The Simple IRA is easy to set up, easy to monitor, and little to no cost. You can do this through your bank, insurance company, and even some payroll companies.

- 401(k) – The biggest difference between the SIMPLE IRA and the 401(k) is the cost of the plan and the annual limits. The contribution limit for 401(k) if you’re under 50 years old is $22,500. If you are older than 50, you can contribute an extra $7,500 annually. But as an owner, the amount you can contribute is dependent on how much your employees contribute. Offering an employer match can kickstart your employees’ savings and motivate them to save more of their own income. Educating and encouraging all employees to save more by contributing more will benefit everyone. There are however a lot more fees associated with a 401(k). On average, a 401(k) can cost about $3,000-$4,000 for a shop to run on an annual basis. So if you have the extra cash you want to put into a retirement account, that $3-4k isn’t too big of a deal. But if you only want to put away $5-10k annually, you might as well stick with a SIMPLE IRA.

Here is Hunt’s analogy on SIMPLE IRA vs 401(k): If you’re putting $6,000 away into a retirement account, you have 2 different options. You’re looking at a Toyota Camry (SIMPLE IRA) and a Ferrari (401(k)). But if you’re only driving 20 mph, you don’t need the expensive fancy Ferrari!

We tend to start our clients on the SIMPLE IRA. If you are easily able to max out the contribution limits, and you want to put away even more each year, then we will move you to the 401(k). Read more about 401(k) here.

If you do not want to, or are unable to do a business-sponsored plan, here are a couple options to get you started:

Personal Plans – The plans below can be done by anyone as long as they don’t already have an employer-sponsored plan. These options are both quick and easy if you don’t want to get something setup within your business. You can also contribute to these plans up until tax day – you don’t have to do it by the end of the calendar year.

- ROTH IRA – This plan does not offer a tax deduction by lowering income, but it will grow tax-deferred. In 2023, the income phase-out range for single filers is $138,000 to $153,000. For married couples filing jointly, it’s $218,000 and $228,000 (these AGI limits change each year.) There are also lower contribution limits: you can contribute up to $6,500 annually ($7,500 age 50 and older). A ROTH IRA is very flexible in that you can take money (principle, not growth) out of the account without any tax consequences.

- Traditional IRA – This option is almost the same as the Roth IRA except you do get a tax deduction. This is usually approximately 25% give or take. So if you max out the contribution at $6,500, you’re looking at saving roughly $1,625 on taxes. That $6,500 is still your money, so you’re basically generating another $1,625 just by moving money around. For the Traditional IRA though, you cannot touch the money until retirement. If you do, not only will you get taxed on the amount you take out, but you will also be hit with early withdrawal penalties. You can end up owing as much as 50% in taxes and penalties for early withdrawal.

Bottom line: We recommend one of the employer-sponsored accounts. Not only will it save you money on your taxes, it will help you have the upper hand when hiring (and keeping) qualified techs. Reach out to your accountant or trusted financial professional for help in getting started.